While currently voluntary and regarded as a benchmark for best practices, there is a strong expectation that, much like its climate-focused counterpart, the TNFD will ultimately become an integral component of global regulatory mandates.

Stay informed with regulations, insights & events by joining our mailer

In a pivotal moment for sustainability, the Taskforce on Nature-related Financial Disclosures (TNFD) has unveiled its long-anticipated final recommendations.

Following the launch of its fourth beta version in March, this release marks a significant step forward in integrating nature-related considerations into the financial world.

Much like its climate-focused counterpart, the Task Force on Climate-related Financial Disclosures (TCFD), TNFD's recommendations offer a comprehensive framework for businesses and financial institutions to assess, monitor, disclose and report on nature-related risks, dependencies, impacts and opportunities. These guidelines aim to harmonise corporate disclosures, enabling businesses, financial institutions and investors to make informed, nature-conscious decisions.

A staggering figure looms over the horizon:

A USD 4.1 trillion financing gap in nature must be closed by 2050 for the world to meet its climate change, biodiversity and land degradation targets.

The TNFD recommendations are a critical tool to increase the private funding necessary to bridge this gap.

What does the TNFD take into account?

In the past two years, the TNFD has embraced an “open innovation” methodology to create and refine the TNFD framework, actively incorporating input and insights from stakeholders spanning more than 60 countries worldwide. It has also been designed to:

- align seamlessly with the language, structure and approach of the TCFD and the International Sustainability Standards Board (ISSB), promoting integrated climate and nature-related reporting;

- accommodate diverse approaches to materiality adopted globally, catering to the information needs of capital providers and stakeholders alike, in line with the ISSB's IFRS Standards, TCFD recommendations and the GRI Standards;

- align with global policy goals, including Target 15, on corporate reporting of nature-related risks, dependencies and impacts, as outlined in the Global Biodiversity Framework (GBF); and

- leverage the most up-to-date scientific insights, drawing from assessments by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) and climate science from the Intergovernmental Panel on Climate Change (IPCC).

What’s included?

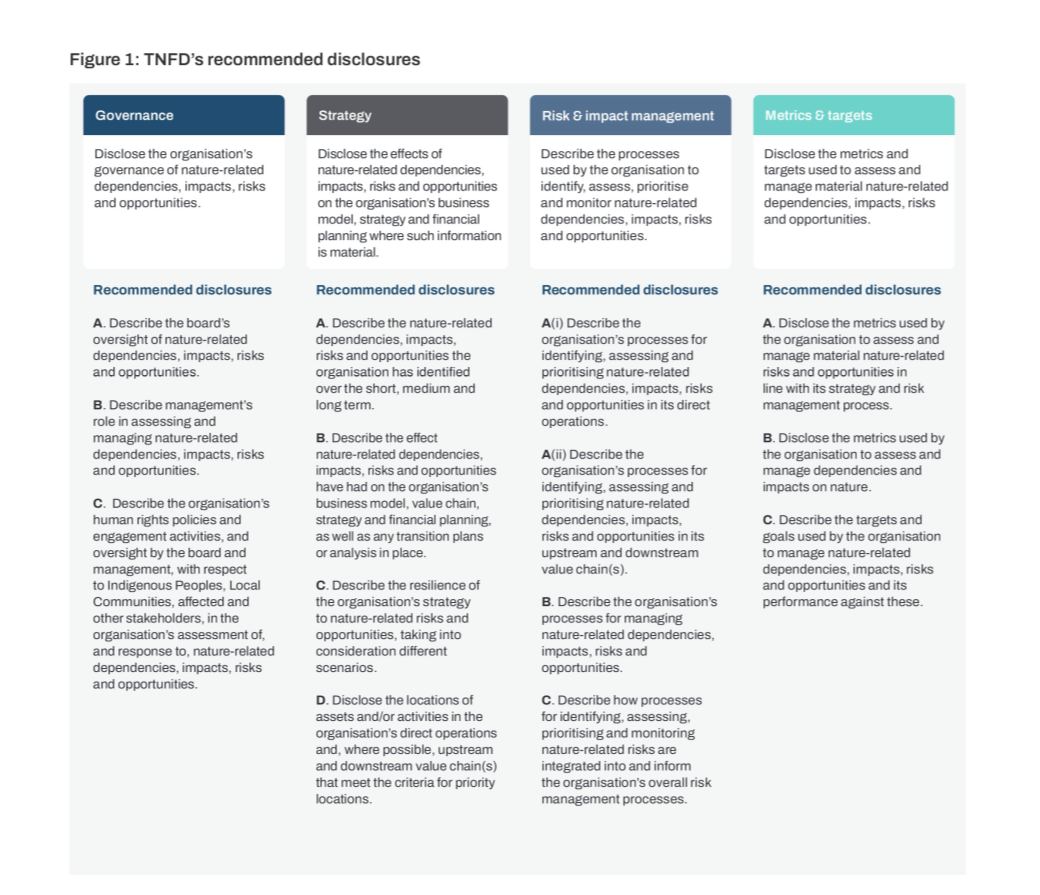

This above approach has culminated in a final framework that has been highly responsive to market feedback. This includes 14 recommended disclosures that encompass the disclosure of nature-related impacts, risks and dependencies throughout the entire value chain. These are organised into four pillars with recommendations mirroring the structure of the TCFD:

- Governance

- Strategy

- Risk & Impact management

- Metrics and targets

Akin to the TCFD framework, TNFD recommendations advocate for assessing risks across various future scenarios and compels businesses to set science-based targets and properly embed nature-related considerations in their strategies. The alignment facilitates comprehension for investors already familiar with the TCFD framework.

More detail on the specific disclosures can be found in the image below.

While currently voluntary and regarded as a benchmark for best practices, there is a strong expectation that, much like its climate-focused counterpart, the TNFD will ultimately become an integral component of global regulatory mandates.

What lies ahead?

To mark its launch, the TNFD has unveiled a campaign for “TNFD Adopters”, denoting organisations that officially register as inaugural TNFD adopters before January 2024. These early adopters will have the opportunity to be showcased in a public announcement scheduled for January 2024 at the World Economic Forum (WEF) Annual Meeting in Davos.

One of the pioneers in this commitment is GSK, which announced its intention to initiate TNFD disclosures at the launch event in New York. GSK plans to commence reporting from 2026, based on data from 2025.

Other notable companies such as Natura &Co, Holcim and Reckitt have already embraced TNFD adoption through private trials.

How can we help you?

In the coming years, the TNFD's journey from voluntary best practice to global regulatory standard will continue to evolve, driven by early adopters, corporate support and the collective commitment to integrate nature into our financial and business decisions.

As the TNFD gains momentum and businesses worldwide embrace its principles, is now the time for you to take action? Get in contact with our team to find out more about our business biodiversity check-in and how it could help you.

The UK has welcomed the launch of the TNFD, noting that it is ‘an invaluable tool for redirecting financial flows towards nature positive outcomes’.